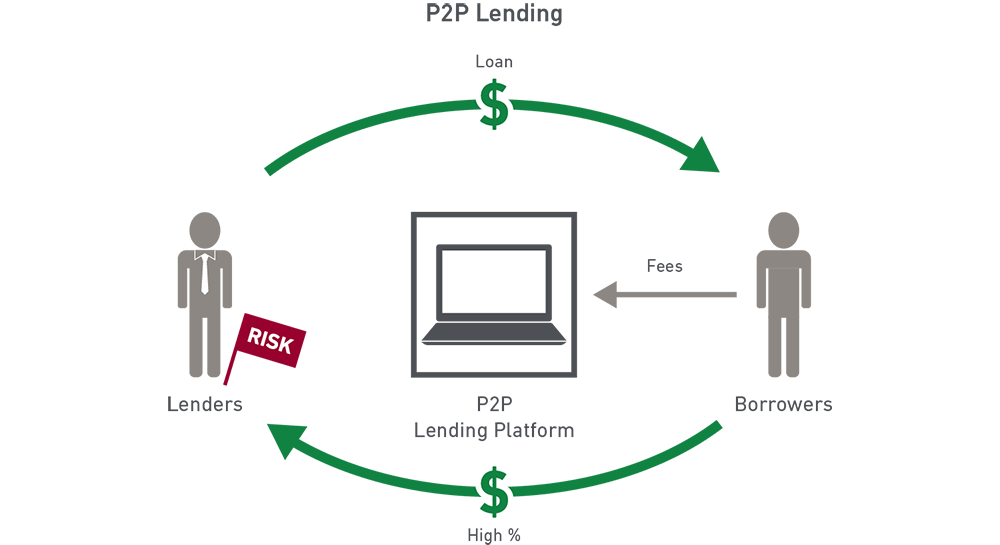

RupeeCircle is one of the newest contenders in the market of p2p lending platforms. RupeeCircle provides loans with minimal hassle. Like all p2p lending institutions, it provides high return rates to the investors on their money, and use their money to provide loan to those in need.

While assigning a loan, RupeeCircle decides the interest rates for the customer via an automated mechanism which calculates the interest based on the risk ratio of the customers, i.e., their financial reliability. The assigned interest rates vary from 12% to 36% depending upon the financial reliability of the customers.

There are a number of distinct advantages of investing money via RupeeCircle, as listed below.

Safe and high quality investments:

Unlike many other p2p lending investing programs, RupeeCircle ensures that only the most safe and high quality investments are made which means that the investors have their money invested in reliable loans with secure returns.

This minimizes loss and maximizes the returns. Only borrowers with the necessary credit score are approved for loans. Furthermore, RupeeCircle has strict guidelines for verification and underwriting during the process of sanctioning of loan, ensuring highest quality investments.

Higher returns:

RupeeCircle is well known for its high peer to peer lending returns. Investing in the high profit p2p lending leads to returns as high as 36% per annum at RupeeCircle. This average rate is much higher compared to the market returns ensuring investors get the maximum return from their investments.

Regular monthly returns:

At RupeeCircle, investors get monthly return on their investments. This is immensely helpful to the customers as they are able to reinvest the additional monthly returns which they get from their investments. Therefore the customers get the chance to maximize their investments, as well as increase their returns.

Easy investing via auto invest:

Investing via RupeeCircle is an easy process. Customerscan set predetermined criteria based on which RupeeCircle makes investments quickly in various loans. This process makes investing an easy task, with the investors simply having to set the preferences based on which the capital is to be auto invested.

Diversification of investments:

RupeeCircle, an innovative peer to peer lending platform allows investors a chance to diversify their investments in various loans, allowing maximum utilization of the investment and thereby maximizing their returns. The user optimization at RupeeCircle helps the investors to invest in different types of loans with varied duration, interest rate and risk grade.

Easy procedure of opting out:

In the event of an investor wishing to liquidate his or her portfolio, RupeeCircle offers an easy procedure for opting out. The investor can list his or her loans in the secondary marketplace which can be then sold off to liquidate the portfolio of the investor.

Ease of use:

One of the major benefits of investing through RupeeCircle is the hassle free and user friendly interface which is provided by the company. The online platform allows customers to keep track of all the investments in their portfolio, thereby ensuring they are thoroughly aware about the state their investments are in.

Peer to peer lending has turned into one of the booming niches of the financial industry. It is safe and easy to use and convenient for both the investors as well as borrowers. RupeeCircle provided numerous opportunities for the investors to invest in and provides them with high returns on their investments.